Manage your Northwestern Mutual Bill Pay Account:

Being a common organization implies they’ve been there for our customers since the very beginning and will keep on being on the grounds that they report to them, not Wall Street. Rather than stressing over transient additions, they adopt a drawn-out strategy both in the manner, they help individuals plan and in the manner in which they work together.

This has served their customers well through a wide range of monetary high points and low points even the monetary emergency. Commonality additionally implies that their policy owners will be a piece of their organization and may profit by yearly profits. So when they progress admirably, you progress nicely, as well.

Features of Northwestern Mutual:

- The level of their customers who remain with us year over year.

- The number of individuals they’re glad to call customers, and who put their trust in Northwestern Mutual.

- The number of years they’ve been there for their customers through declines, despondencies, and two World Wars.

- The sum they’ve added to subsidize research for kids battling the disease, and backing for their families.

Northwestern Mutual Login:

- To pay the bill online open the page opens login.northwesternmutual.com

- Once the page appears at the center you need to provide a username, password.

- Now hit on the ‘Log in’ button.

Reset Northwestern Mutual Login Credentials:

- To reset the login initials open the page login.northwesternmutual.com

- After the page opens in the login homepage click on ‘Forgot your username’ button.

- Enter the email address and proceed. To recover the password enter username and follow the prompts.

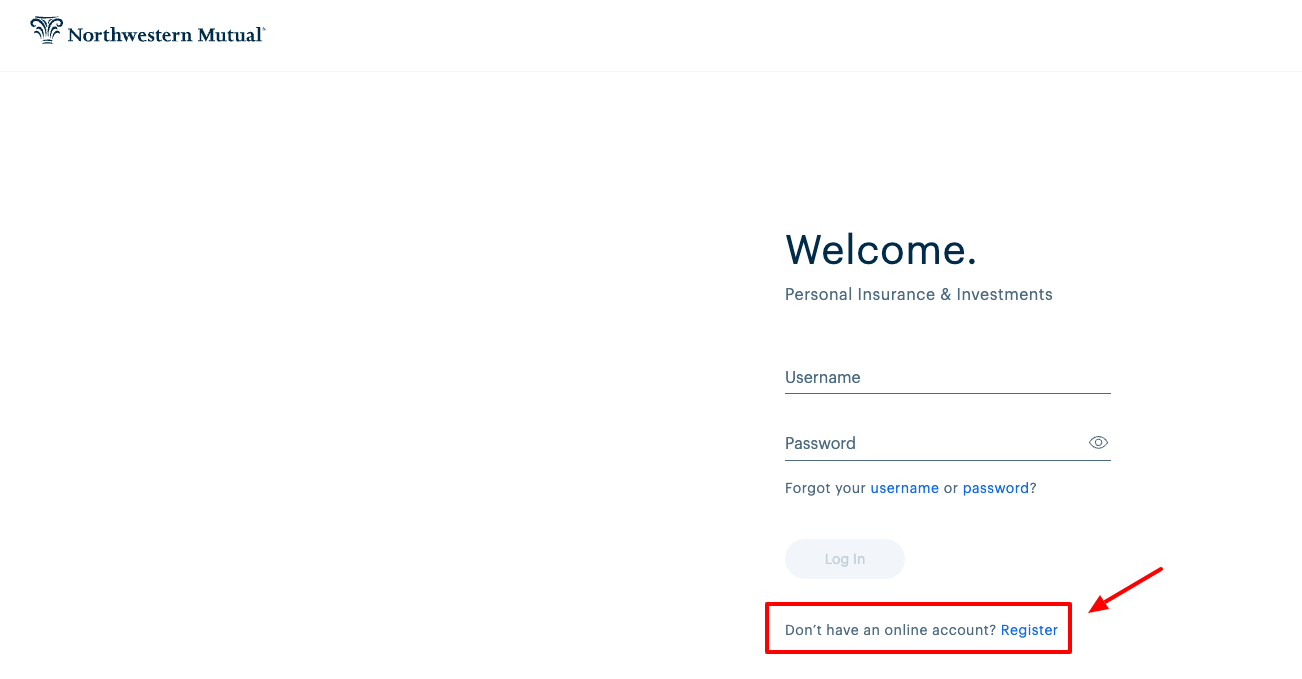

Register for Northwestern Mutual Account:

- To register for the account open the page login.northwesternmutual.com

- As the page opens in the login homepage hit on the ‘Register’ button.

- You will be forwarded to the next screen to provide policy, billing or account number, your name, last four numbers of TIN or SSN.

- Now click on the ‘Next’ button.

Northwestern Mutual Bill Pay by Phone:

- You must have the payment details and pay the bill through phone number.

- You have to call on, 1-800-388-8123. (414) 665-7694.

Northwestern Mutual Bill Pay by Mail:

- You can also pay the bill through mail. You have to send the bill to a particular address.

- Send it to, 818 E. Mason St. Milwaukee, WI 53202.

Also Read: Manage your Georgia Natural Gas Account

Northwestern Mutual Insurances:

- Single Life Insurance: This sort of strategy safeguards one life and is accessible for the term, entire life, and general life choices.

- Second-to-Die Life Insurance: This sort of strategy protects two lives, however just pay out on the subsequent passing, for example, survivorship life arrangements.

- Term: Life protection temporarily period, not a lifetime.

- Customary Portfolio Based: This is for what seems like a forever item, which has money esteems, and a passing advantage. This is a perpetual life strategy type.

- Variable Universal Life: This is a general life strategy with speculation components that has the potential for misfortunes or gains for individuals open to accepting a higher danger.

- Portfolio-Based Universal Life: This is a scope of widespread life items with adaptability in the premium and passing advantage. Less danger than the variable life since it has a base revenue crediting rate. Demise advantage esteems might be ensured relying upon the arrangement.

- Term Life: Non-level-term approaches will have expanding charges. Albeit Northwestern Mutual offers transformation, the change time frame has indicated timetables, so you will need to make certain to consider this when you pick an arrangement.

- Term Conversion Options: Term transformation is accessible for indicated terms on the term life strategy. On the off chance that you convert to an entire life strategy during the transformation time frame, you will profit by ensuring acknowledgment inclusion and advantage from the slower pace of being more youthful instead of standing by sometime down the road when disaster protection rates increment.

- Entire Life: Whole life coverage is a sort of perpetual protection strategy that can cover you for your lifetime.

- Singular Whole Life: An individual entire life plan covers one individual on the strategy and pays a passing advantage to their recipient when they bite the dust. These are entire life plans; they don’t terminate following a specific number of years like term life.

Northwestern Mutual Contact Details:

To get further details call on 800-388-8123.

Reference Link: