Pay The Los Angeles County Property Taxes

The Los Angeles tax collector has this new tax management system to fulfill the needs of owners of more than one properties. The agency encourages to evaluate the tax management of the properties you own and make payments of the related obligations on the same. The system also stores the information associated with every single property you own and it includes the Assessor’s identification number and the PIN.

The property tax management system

You will get to create a personalized account

Can add more than 100 properties based on the list

You can create and customize the list to sort and track the properties you have.

Get to verify payment status

Get to update existing lists and create the new ones as well.

Pay the online payments directly from the list easily.

Read Also : Kmart Payment Methods

Request duplicate annual secured property tax bill

To have this you need to visit, www.ttc.lacounty.gov/request-duplicate-bill

Here you will get a white form and you need to fill it up. The first thing you have to type,

AIN

Situs address

First name

Last name

Email address

Phone number

Mailing address

City

State

Zip code

Check the validation box and click on ‘Submit’.

Do follow the prompts and you will be able to request for the duplicate bill.

Property tax installments plans

You will get two plans from it,

Four-pay plan

Five-day plan

For any other assistance on the tax plans, you can send an email to, info@ttc.lacounty.gov, or you can call at 213.974.2111.

Create an account with the Los Angeles property taxes and you will be able to manage the taxes and payment as well.

Create an account with Los Angeles County property tax

For this part visit, www.vcheck.ttc.lacounty.gov

Here accept the terms of use

Check the validation box and click on ‘Next’.

On the next page, choose the option, ‘Property tax management system- account login’.

Here click on, ‘Create an account’.

In the adjacent page, type,

Your email address

Confirm the same

Set a password

Confirm password

First name

Last name

Phone number

Set 3 security questions and answer the same and then press on, ‘Submit’.

Follow the instructions after this you will get to create the account.

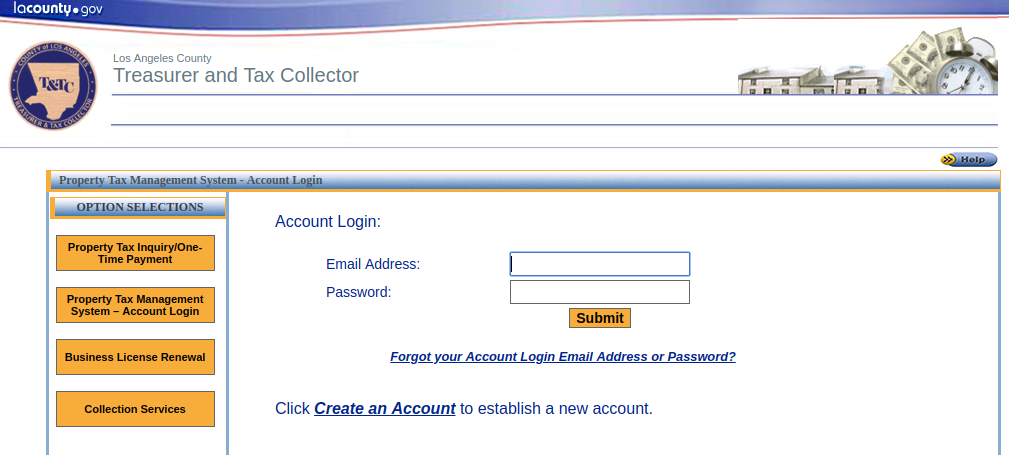

Logging into the property tax management system

To have this you need to go to, www.vcheck.ttc.lacounty.gov

- Then select the “Property Tax Management System-Account Login”

Here type the registered email address and the password then press on, ‘Submit’.

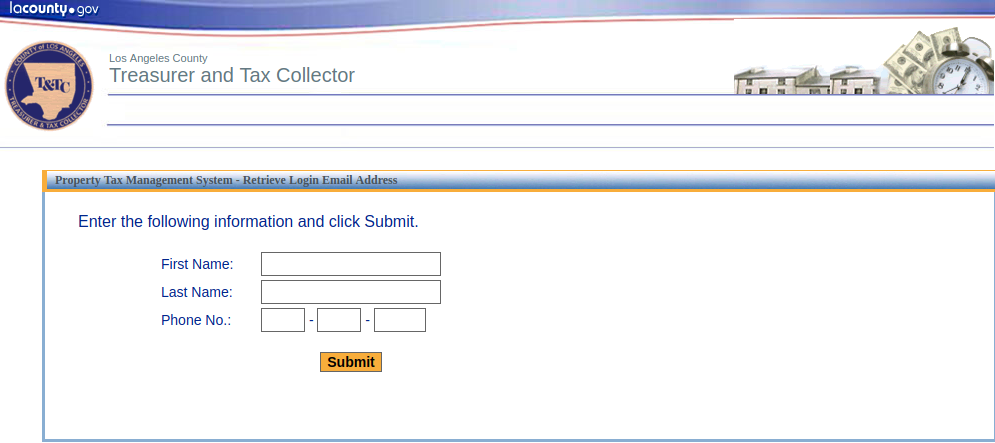

Forgot username or password

In any case, if you have lost the login details of property tax management then you have to visit the same page again, and then in the login page, press on, ‘Forgot your account login email address or password?’. Here in the next change choose the option, for the password, click on, ‘I forgot my password’ and press on, ‘Next’. Input the registered email address and hit on ‘Submit. For the email address, choose the, ‘I forgot my login email address’ and press on ‘Next’. Here enter the,

First name

Last name

Phone number and click on, ‘Submit’.

Avoid the penalties

For secured property taxes

You will have to pay the 10 percent of the penalty.

For unsecured property taxes

You have to pay 10 percent and with that $20 notice of enrollment cost.

Payment for the property tax management

There are 6 options you will get for the payment, online, e-check, credit or debit card, by mail, by phone, in person. For online you have to visit, www.vcheck.ttc.lacounty.gov/index and from here you can go to the login page to pay the bill.

Online payment

To pay online you need to log in and before that have to create an account. After that, you can pay the bill online.

E-check payment

For this, you will need the PIN and the highest transaction amount is $999,999.99.

Credit or debit card payment

This payment method can be used 24 hours and you can pay by credit or debit card.

By mail

You can send the payment for secured property taxes to, Los Angeles County Tax Collector, P.O. Box 54018, Los Angeles, CA 90054-0018. For the unsecured, Los Angeles County Tax Collector, P.O. Box 54027, Los Angeles, CA 90054-0027.

Pay by phone

To pay by phone you need to call at the toll-free number- 1-888-473-0835.

In person

To make an in-person payment you have to go to, Los Angeles Tax Collector office in the first-floor lobby of 225 North Hill Street, Los Angeles, CA 90012. The payments are accepted between 8:00 a.m. and 5:00 p.m.Monday to Friday, except the Los Angeles County holidays.

Contact details

If you are looking for any assistance then you have to call at the toll-free number for secured tax at, 888.807-2111 for the unsecured you can call, 213.893.7935.

Reference :

www.ttc.lacounty.gov/request-duplicate-bill

www.vcheck.ttc.lacounty.gov/index