How to Avail Home Loan Advantage with Morgan Stanley

Morgan Stanley works as a worldwide money related administration organization. The firm gives venture banking items and administrations to its customers and clients including companies, governments, money related foundations, and people. It works through the accompanying industry sections: Institutional Securities, Wealth Management, and Investment Management. The Institutional Services section gives a budgetary warning, capital-raising administrations, and related financing administrations in the interest of institutional speculators.

Morgan Stanley intends to bring its home loan beginning business in-house to improve client support and create more business. Morgan Stanley is building up another computerized contract application device in an offer to get a greater amount of its current customers to go to it for home credits. The Wealth Management portion offers financier and speculation warning administrations covering different kinds of ventures, including remote monetary standards, fixed-pay securities, equities.

Then the choices, prospects, valuable metals, common assets, organized items, elective speculations, unit venture trusts, oversaw fates, independently oversaw accounts, and shared store resource assignment programs. The Investment Management section gives land, value, fixed salary, elective speculations, and vendor banking procedures.

About home loans of Morgan Stanley

Home loans

A suite of private home loan items with serious rates for qualified candidates.

Protections based loans

You might have the option to use your venture record and increase adaptable access to credit for certain close to home interests, business needs or other unforeseen costs.

Money management

A suite of items and administrations to meet customers’ ordinary money the executives needs.

A multi year credit with a fixed intrigue rodent for a characterized period

Predictable head and intrigue installments during the characterized period

After the characterized period, the rate and regularly scheduled installment modify yearly through year 30

Rate dependent on the 1-Month LIBOR list and may vary month to month

A 25-year movable rate contract giving 10 years of intrigue just installments, trailed by the completely amortizing head and intrigue installments for staying 15 years

Shorter-term credits take into account speedier result with less intrigue cost with higher regularly scheduled installments

Longer-term credits offer lower regularly scheduled installments with higher intrigue costs

Morgan Stanley Home Loans exclusive Features

Permits qualified customers to utilize qualified protections in a Morgan Stanley money market fund as insurance for a credit that can be utilized for part or the entirety of their up front installment Reduce or dispense with the need to make a money initial installment toward the acquisition of a home for you or a relative

In the event that you pick to promise advantages for decline the credit to-esteem, you may profit by a decrease in financing cost.

Your Morgan Stanley relationship may help qualify you or your close relatives for a limited rate or shutting cost credit

Thinks about the qualified resources of grandparents, guardians and kids to help fit the bill for a limited home credit rate

Accessible for an assortment of advance sorts.

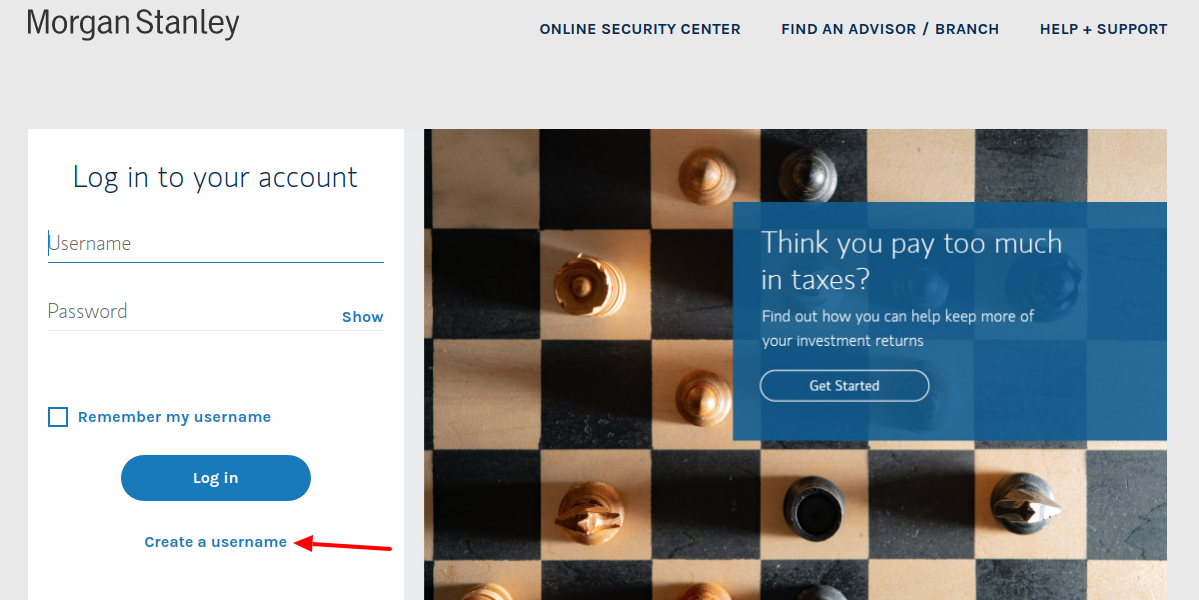

How to login with Morgan Stanley home loan

To login go to, www.morganstanleyhomeloans.com

Here, at the middle as you have to scroll down, tap on, ‘Login’.

Here, at the middle left, tap on, ‘ Create a username’. Here type,

Account number

The last 4 digits of SSN you possess

If you don’t have this number, you can use your passport number

Then, tap on the button, ‘Continue’.

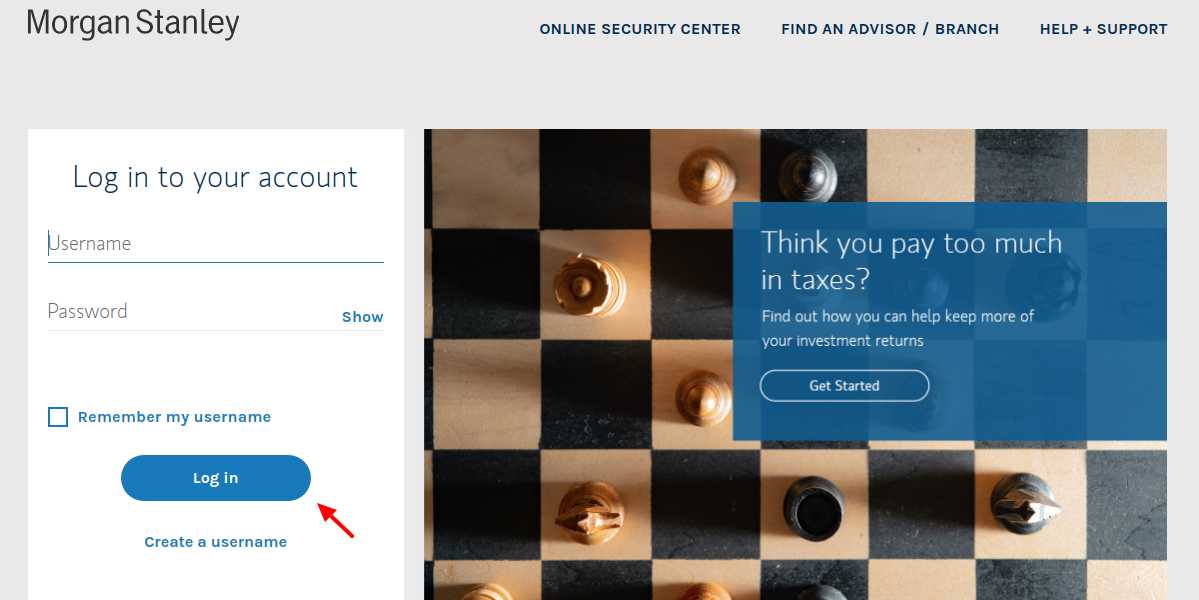

How to login with Morgan Stanley home loan

To login visit, www.morganstanleyhomeloans.com

Here, at the middle as you have to scroll down, tap on, ‘Log in’.

Here, at the middle left, provide the info,

Username

Password

Then, check on, ‘Log in’.

Login help

To get login help go to, www.morganstanleyhomeloans.com

Here, in the login change tap on, ‘Forgot username?’. Here you provide,

You type, for Morgan Stanley online.

Account number

The last 4 digits of SSN you possess

If you don’t have this number, you can use your passport number

Then, tap on the button, ‘Continue’.

For stock plan connect here to provide,

Company stock symbol

Then, check on, ‘Next’.

For password tap on, ‘Forgot password?’. You must give details,

For Morgan Stanley, type,

Account number

The last 4 digits of SSN you possess

If you don’t have this number, you can use your passport number

Then, tap on the button, ‘Continue’.

For Stockplan the info will be the same.

Also Read : How To Pay Choptank Electric Bill Online

How to find a Morgan Stanley financial advisor

To find it go to, www.morganstanleyhomeloans.com

Here, at the upper side tap on, ‘Find a financial advisor’.

In the new taken tab, at the middle write the details,

The location

The distance

You can also turn on the GPS.

You can also search by the branch or name

Customer care

To get further help from Morgan Stanley call on, 1 (888) 454-3965. You can write to, 1585 Broadway. New York, NY 10036. Also, check these pages,

Reference :

www.linkedin.com/company/morgan-stanley

www.facebook.com/morganstanley

www.instagram.com/morgan.stanley