Pay The 1120S Tax Return

The IRS or the internal revenue service is the revenue service for the U.S federal government and it is appointed by the five-year term president of the States. The agency was founded in 1st July 1862 and has its headquarter in, Washington, D.C., United States. IRS has currently, 76,832 employees working with them and it works under its parent organization, United States Department of the Treasury.

If you want to pay the 1120S tax return then you will find some providers for the same, however, you can always create an account with IRS for further help.

Create an account with IRS

To create an account go to, www.irs.gov/payments/view-your-tax-account

Here scroll down and press on, ‘Create or view your account’.

In the next page, at the left side press on, ‘Create account’.

Click on, ‘Continue’ after reading the specifications

You will need some information to fill up the form such as,

Full name

Email

Birthdate

Your social security number

The tax filing status

Your current address and if you have all of these with you then click on, ‘Yes’.

After this, you have to specify that you have some accounts just for the identity verification purpose. You have to have one of these,

Credit card

Student loan

Mortgage or home equity loan

A home equity line of credit

Auto loan, if you have any of these then click on, ‘Yes’.

In the next page, press on ‘Continue’.

Here type your,

First name

Last name

Email address

Confirm email address and press on, ‘Send code’.

Follow the prompts and get to create an account.

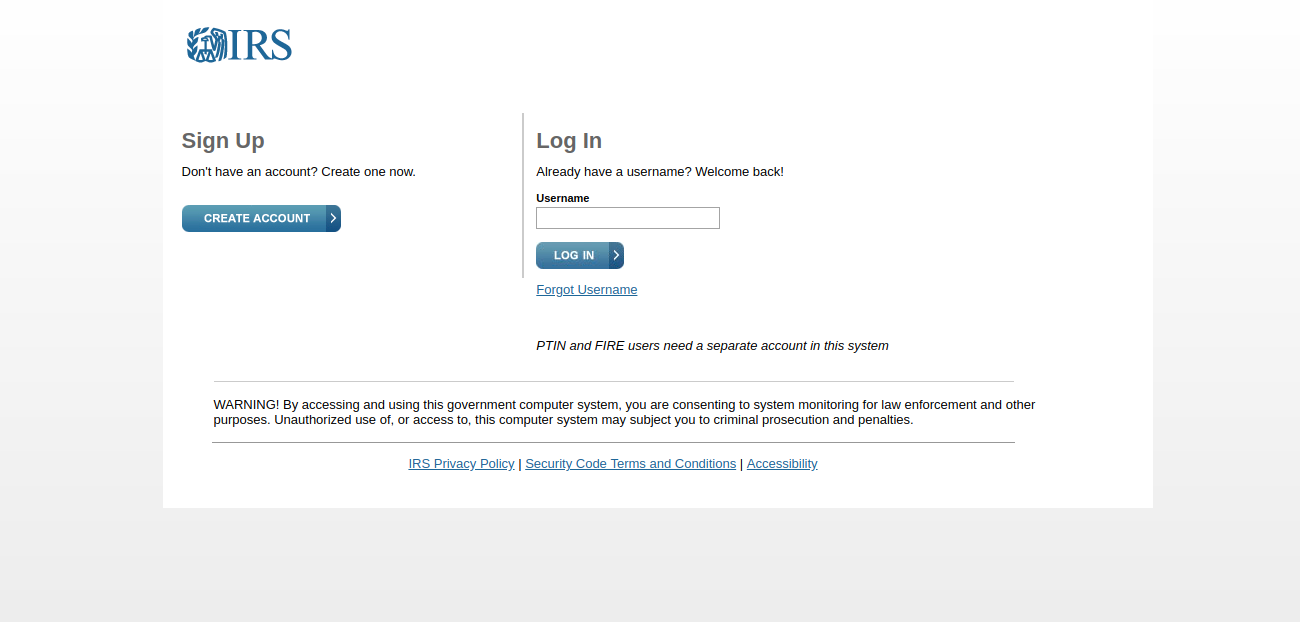

Logging in with IRS

To log in, visit, www.irs.gov/payments/view-your-tax-account

Here scroll down and press on, ‘Create or view your account’.

On the adjacent page, type the username and click on ‘Log in’.

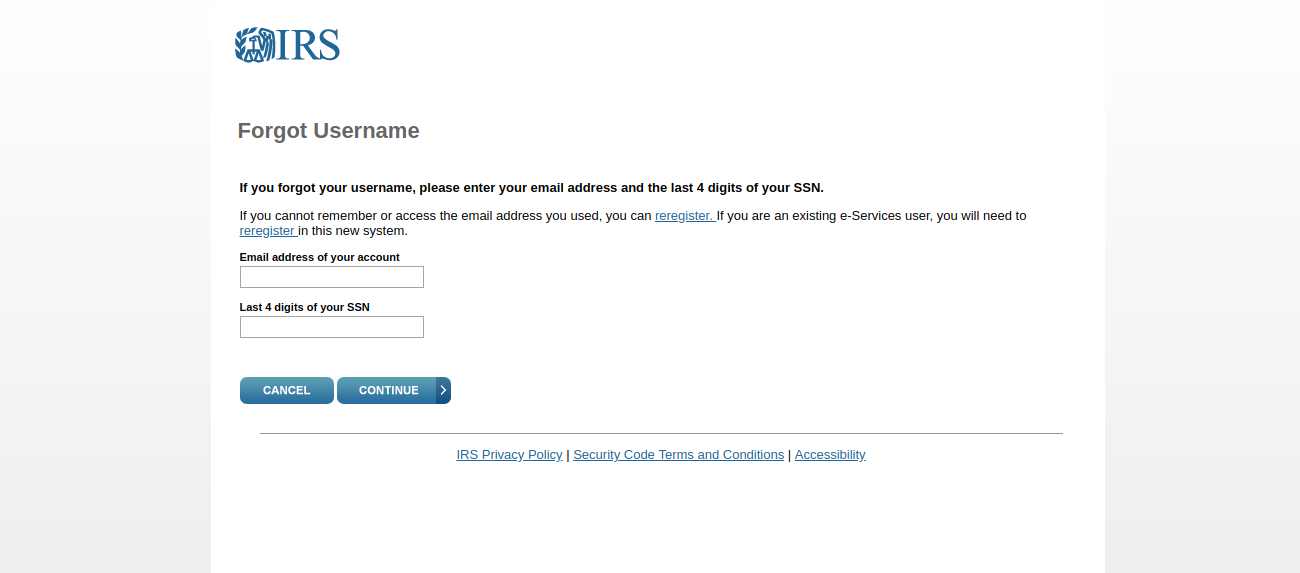

Forgot username or password

If in any case you have forgotten the login credentials and to get that back you can visit the same page as before and here click on, ‘Forgot username’. Here type the email address in the account, the last 4 digits of your social security number and hit on, ‘Continue’. Check the later instructions and you will be able to get the information.

Payment for 1120S tax return

Here you will get two options, online and by mail. For the online part, you can visit, www.irs.gov/e-file-providers/1120x-mef-providers.

Online payment

To pay online you have to go through direct pay. You can visit, www.irs.gov/payments. Here click on, Direct pay’.

Click on ‘Make a payment’.

On the next page, type the.

Select the exact reason

Apply payment to

Mention the tax period of payment and press on ‘Continue’.

Follow the later prompts and you will be able to pay by direct pay.

Credit or debit card pay

You will get another option for IRS payment, which is credit or debit card payment.

For this too, you can go to, www.irs.gov/payments

Here click on, ‘Debit or credit’.

From here you have to select the payment processor, then you can proceed with the payment process.

In cash

You can pay by cash and it takes 5 to 7 days to process the payment.

For this , you have to visit the official payment site, www.officialpayments.com/fed/index.jsp

Here you will be able to make a payment with PayNearMe

You will get an inforinformation of payment from the IRS, and the process will take 2 to 3 days.

After the verification of the information provided by you, IRS will send you an email, alonf with a link to your payment code. You can print the code or send it by your mobile.

In the last step, you have to venture to the store where you will get a PayNearMe , here you have to ask for the code. After the payment is done, you will get a reciept. It will atke 2 business days to show the payment made from your account.

EFTPS

www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-system

Check this site and get all the details on this payment system.

Electronic funds withdrawal

Get to know about this convenient method from here, www.irs.gov/payments/pay-taxes-by-electronic-funds-withdrawal

Same day wire

For this you have,e to contact your bank and know the details, from, www.irs.gov/payments/same-day-wire-federal-tax-payments.

Pay by mail

If you want to send the payment via mail then you have to search by your state. Also, you must send know the main office of IRS at, Internal Revenue Service Center, P.O. Box 409101, Ogden, UT, 84409.

Contact details

If you have any query with IRS property taxes then you can call at the general number- 844-545-5640.

Reference :