Pay The Estimated Taxes

The IRS is the revenue service provider in the United States and its federal government. The agency is appointed by the five-year term president of the USA. It has its headquarter in, Washington, D.C., United States and was founded in 1st July 1862. IRS currently has 76,832 employees and works under its parent organization, United States Department of the Treasury.

The payers of estimated tax

Not everyone holds as the payer of the estimated tax but there are some categories if you fall under the same, then you have to pay the tax. The payers have to be, some individuals, their partners, sole proprietors, shareholders, corporations. You can check the worksheets from here, www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes, and you will get more details on the same.

The non-payers of estimated tax

If you are a receiver of salary or wages then you don’t have to pay the same. In this case, you can talk to your employer to withhold extra taxes from your earnings. Also, you don’t have to pay this if you,

Had no tax liability for at least on the past years

You have to be a citizen of the U.S for at least one year.

If your past tax year has been covered in 12 months.

Count the estimated tax

To do this you have to figure your gross income, deductions, taxes, credits, taxable income for the recent year. You can make use the past year’s federal tax return for the help, or you can use www.irs.gov/pub/irs-pdf/f1040es.pdf this form to figure the same out. If you have estimated that your earnings have been high then you can go for another of the same worksheet. If the income is low then calculate with another of the worksheet.

The penalty for the underpayment

If you owe less than $1000 then you must try to avoid the penalty, and pay the tax in the proper amount. The penalty can be avoided if the locality has gone through a natural disaster or any kind of personal injury or disability or if you have retired.

Payment of estimated tax

To pay the tax you will get 4 ways, direct pay, EFTPS pay, mail payment, phone payment.

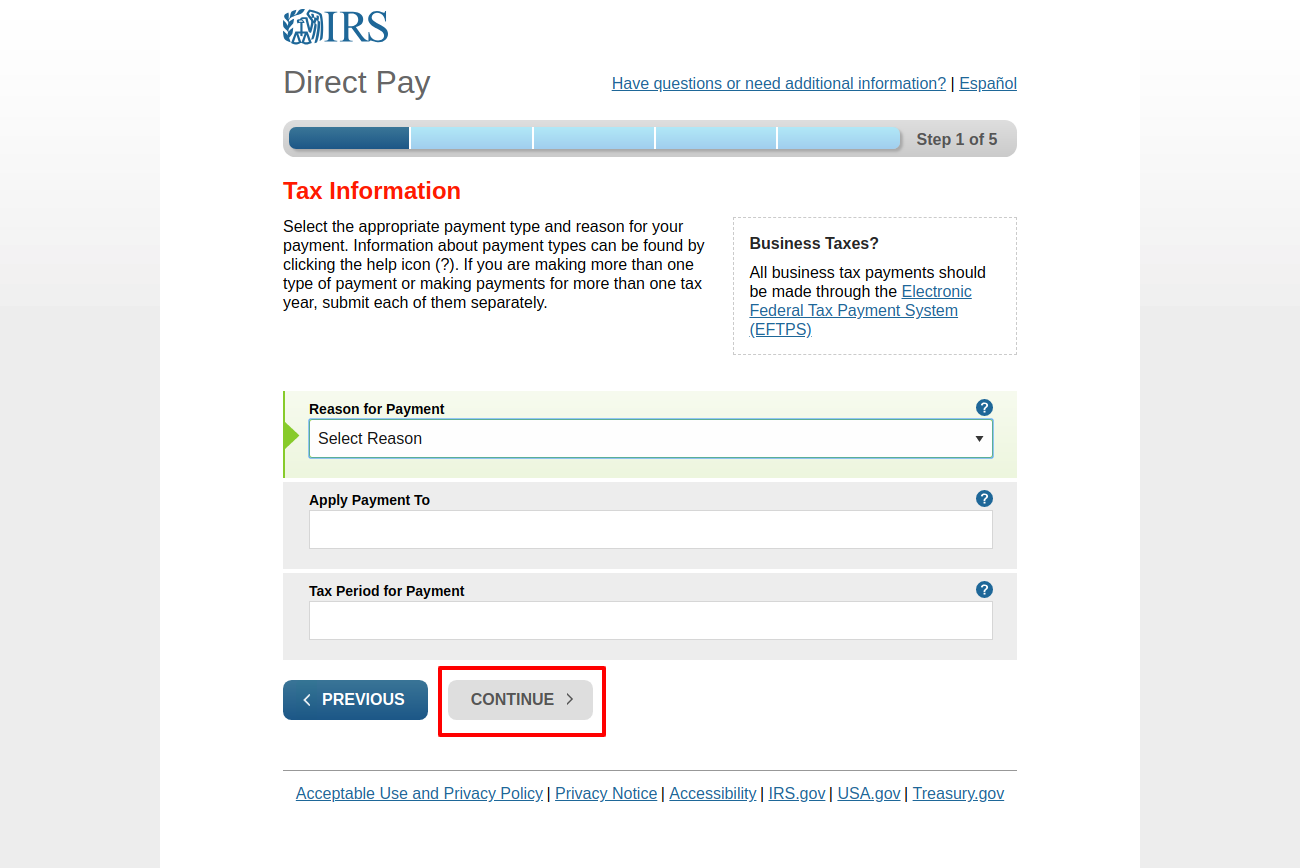

Direct pay

For this you need to go to, www.directpay.irs.gov/directpay

Here type your,

The reason for payment

Apply payment to

The tax period of the payment and click on ‘Continue’.

Follow the prompts after this and you will be able to pay.

Read Also : Epayitonline Bill Paymen

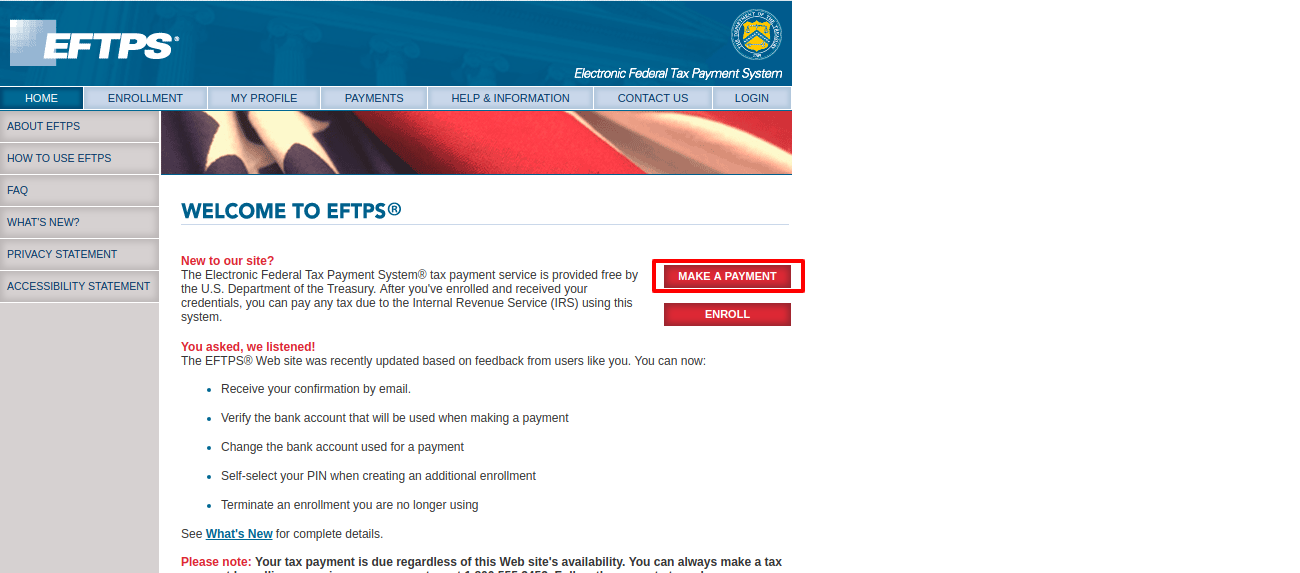

To have this you have to visit, www.eftps.gov/eftps

Here at first, you need to enroll, so click on the same.

Agree to the terms of services and choose the taxpayer type.

Next, you have to type the,

Primary taxpayer social security number

Primary taxpayer name

Primary taxpayer U.S. phone number

The international phone number

If you want to add a joint applicant then click on the small box.

Enter the name

Specify the country

Address

City

State

Zip code

US phone number and the international one.

Routing number

Account number

Re-enter the same

Specify the account type and click on ‘Review’.

Follow the prompts and you will be enrolled.

Make the payment

To make a payment you have to go to, www.eftps.gov/eftps

Click on, ‘Make a payment’.

Type the EIN or the SSN

Type the PIN

Enter the internet password and click on ‘Login’.

Check the later instructions and get to make the payment.

Pay by mail

To send the payment via mail, you can find the address from, www.irs.gov/filing/where-to-file-addresses-for-taxpayers-and-tax-professionals-filing-form-1040-es.

Pay by phone

You can call at the toll-free number- 1-800-555-4477 and make payments.

Contact details

If you are seeking any help from the IRS then you can call at the 800-829-1040, and this is for the individuals. For the businesses, 800-829-4933.

Reference :

www.directpay.irs.gov/directpay

www.irs.gov/filing/where-to-file-addresses-for-taxpayers-and-tax-professionals-filing-form-1040-es