Pay The South Carolina Sales Tax

South Carolina taxes are adjusted and exemptions with deductions of federal tax returns. Taxes usually ranges from 0% to 7% on the taxable income. The sales taxes check with responsibility too, and if you fall under the category of the same then you must ensure the payment.

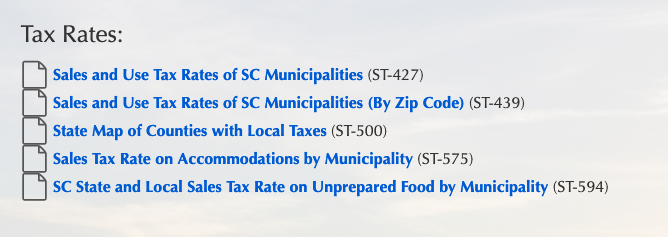

Rates of South Carolina sales taxes

To know about the same you need to go to, www.dor.sc.gov/tax/sales

Here scroll down and you will get rates on pdf. You can download them for convenience.

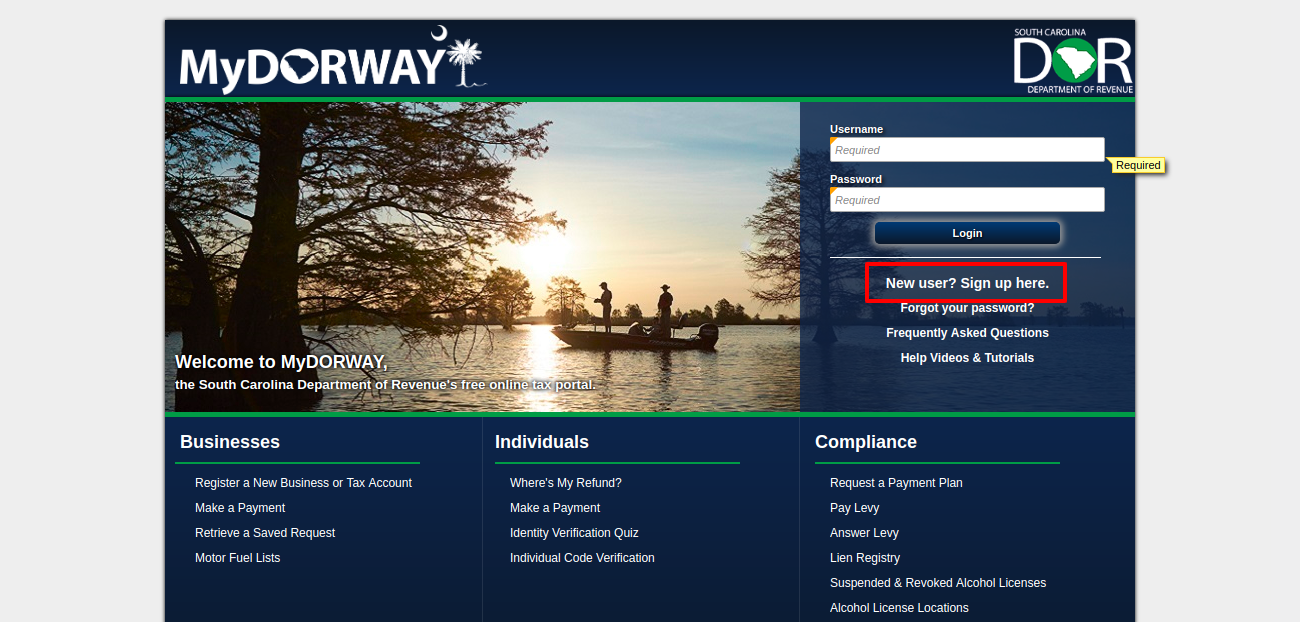

Register with MyDORWAY

To get registered you need to go to, www.mydorway.dor.sc.gov

Here at the right side click on, ‘Sign up here’.

Press on, ‘Next’.

Here choose business and the type,

ID type

ID number

Legal name or last name then click on, ‘Next’.

Logging in to MyDORWAY

To log in, visit, www.mydorway.dor.sc.gov

In the right side of the page type, the username and the confirmed password then click on, ‘Login’.

Read Also : Renown Health Bill Payment Guide

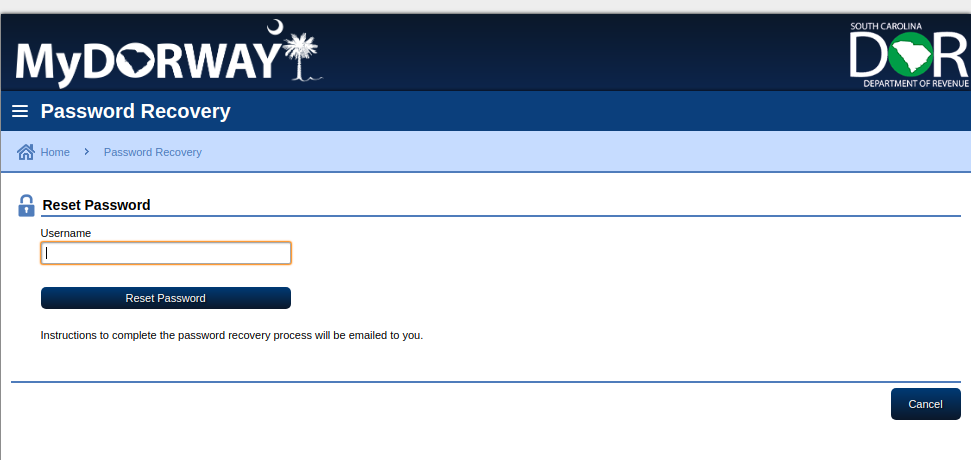

Forgot username or password

If you have lost your username or password you must visit the same page as before. In the exact place press on, ‘Forgot your password?’. Here input the username and then click on, ‘Reset password’. Follow the later prompts to get back the information.

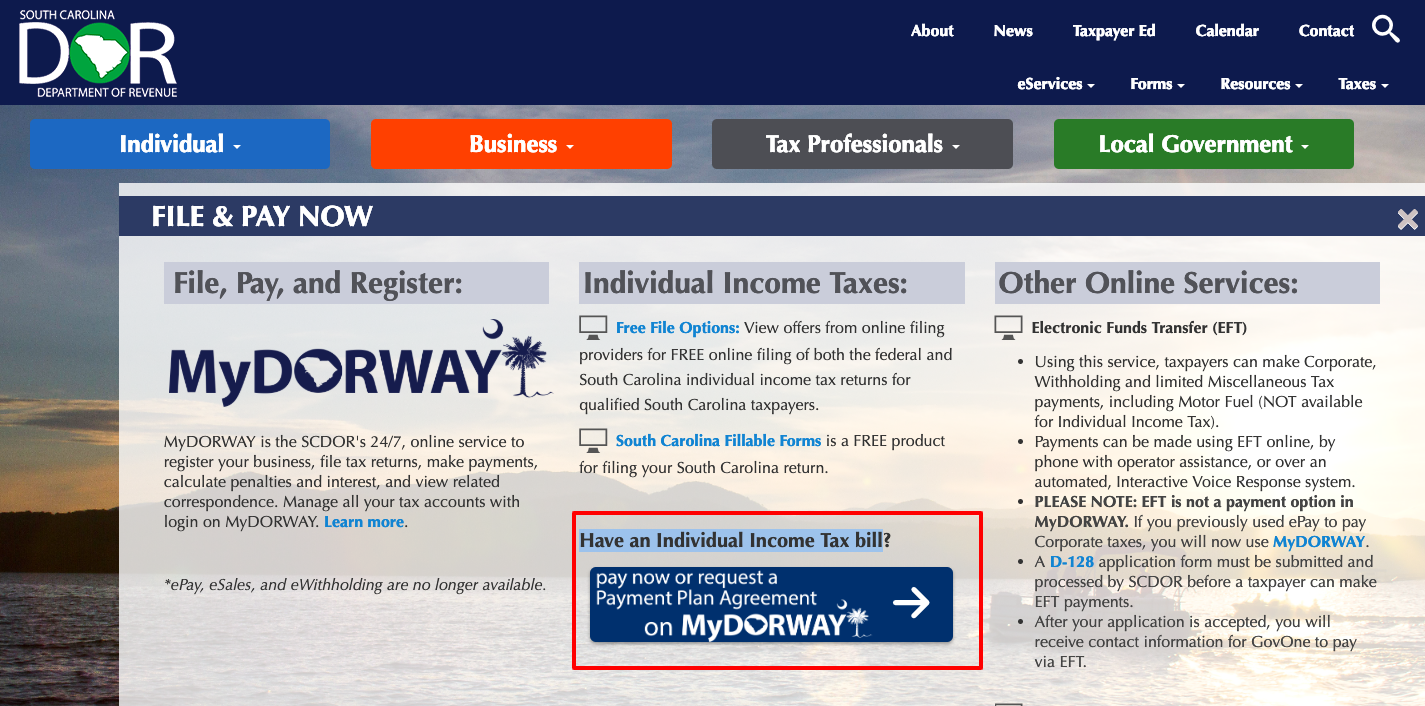

Pay the South Carolina sales tax

For this, you will get two options and they are online and mail payment. For online, you can visit, www.dor.sc.gov/services/file-and-pay-now and go to this Have an Individual Income Tax bill section and follow the process.

Online payment

To pay online you need to check the above link and the process.

To pay by mail you need to send the money order to, South Carolina Department of Revenue, Sales Tax, PO Box 125, Columbia, SC 29214-0400.

Contact details

If you are looking for any assistance then you must call on the toll-free number- 1-844-898-8542.

Reference :

www.dor.sc.gov/services/file-and-pay-now