Apply And Pay For BMO Harris Cash Back Mastercard

BMO Harris bank works under its parent organization, Bank of Montreal and has its headquarter in Chicago, Illinois, United States. The bank operates in a number of places in the U.S. such as Indiana, Arizona, Missouri, Minnesota, Kansas, Wisconsin, and Florida. BMO Harris was founded by Norman Wait Harris and currently has 14,200 employees working with the bank. The concern also has subsidiaries, BMO Harris Equipment Finance Company and so on.

The bank offers various types of credit cards which will meet the expectations of every person. From consumer credit cards to business ones all are available with BMO Harris.

There are 6 total cards available with BMO Harris, they are,

Premium Rewards Mastercard

Get 3 points per $1 spent on eligible dining, hotel, and airfare, up to $2,500 in combined spend each calendar quarter; also get 1 point per $1 spent on any other purchases

Get introductory Offer of 35,000 bonus points when you spend $5,000 in the first 3 months of account opening. Avail 15% anniversary point bonus every year with this card. No Foreign Transaction Fees that you have to pay. Get 0% introductory APR on purchases for 6 months from account opening date. After that, a variable APR applies, currently 16.24% to 24.24%, based on your credit score. Avail 0% introductory APR on balance transfers for 12 months from date of first transfer when transfers are completed within 90 days from date of account opening. After that, a variable APR applies, and you have to pay currently 16.24% to 24.24%, based on your credit score. Low annual fee of $79 you have to pay

Cash Back Mastercard

Get $200 cash back bonus when you spend $2,000 in the first 3 months of account opening. Get 2% cash back per $1 spent on gas and grocery purchases, up to $2,500 in combined spend each calendar quarter; also get 1% cashback on all other purchase. Avail 0% introductory APR on purchases for 6 months from account opening date. After that, a variable APR applies for you, and currently 16.24% to 24.24%, based on your credit. Get 0% introductory APR on balance transfers for 12 months from date of first transfer when transfers are completed within 90 days from date of account opening. After that, a variable APR applies, currently 16.24% to 24.24%, based on your credit. No annual fee have to pay by your side

Platinum Rewards Mastercard

You will receive 2 points per $1 spent on eligible gas and grocery purchases, up to $2,500 in combined spend each calendar quarter2. Receive 1 point per $1 spent on all other purchases. Get introductory Offer: 25,000 bonus points when you spend $2,000 in the first 3 months of account opening. Learn more about intro bonus points. Avail 10% anniversary point bonus every year. Get 0% introductory APR on purchases for 6 months from account opening date. After that, a variable APR applies, currently 16.24% to 24.24%, based on your credit score.

Avail 0% introductory APR on balance transfers for 12 months from date of the first transfer when the transfers are completed within 90 days from date of account opening. Just after that, a variable APR applies, currently 16.24% to 24.24%, and it will be based on your creditworthiness. No annual fee has to pay from your side.

Platinum Mastercard

Get 0% introductory APR on purchases for 6 months from account opening date. After that, a variable APR applies, currently 14.24% to 21.24%, this will be based on your creditworthiness. Get 0% introductory APR on balance transfers for 15 months from date of the first transfer when transfers are completed within 90 days from date of account opening. After that, a variable APR applies, currently 14.24% to 21.24%, it will be based on your creditworthiness.

Business Platinum Mastercard

Get 0% introductory APR on purchases for the first 9 months from the date of opening account. Avail balance transfers with 0% introductory APR for nine months. No annual fee has to pay by your side. Avail access to a variety of great Mastercard benefits

Business Platinum Rewards Mastercard

You will get 0% introductory APR on purchases for the first 9 months from the date of opening account. Avail balance transfers with 0% introductory APR for nine months. Get rewards card with flexible points redemption options. No points expiration or limits you have to pay. No annual fee you have to pay

You will get the introductory bonus as you will earn 25,000 bonus points after you spend $6,000 in net qualifying purchases in the first three months. Get 1 point for every $1 spent.

Benefits of Cash Back Mastercard

Get $200 cash back bonus when you spend $2,000 in the first 3 months of account opening.

Get 2% cash back per $1 spent on gas and grocery purchases, up to $2,500 in combined spend each calendar quarter; also get 1% cashback on all other purchase.

Avail 0% introductory APR on purchases for 6 months from account opening date.

After that, a variable APR applies for you, and currently 16.24% to 24.24%, based on your credit.

Get 0% introductory APR on balance transfers for 12 months from date of first transfer when transfers are completed within 90 days from date of account opening.

After that, a variable APR applies, currently 16.24% to 24.24%, based on your credit.

No annual fee have to pay by your side

Rates and fees of Cash Back Mastercard

APR is 24.24%

The purchase intro is 16.24%

The late payment is $37

Return payment is $37

The balance transfer is $10

The cash advance is $10

The annual fee is $79

Eligibility criteria for Cash Back Mastercard

Your age has to be at least 18 years

Have to have a U.S. Social Security Number

Have to have a street, rural route, or APO/FPO mailing address.

You have to be an account holder of BMO Harris.

Apply for Cash Back Mastercard

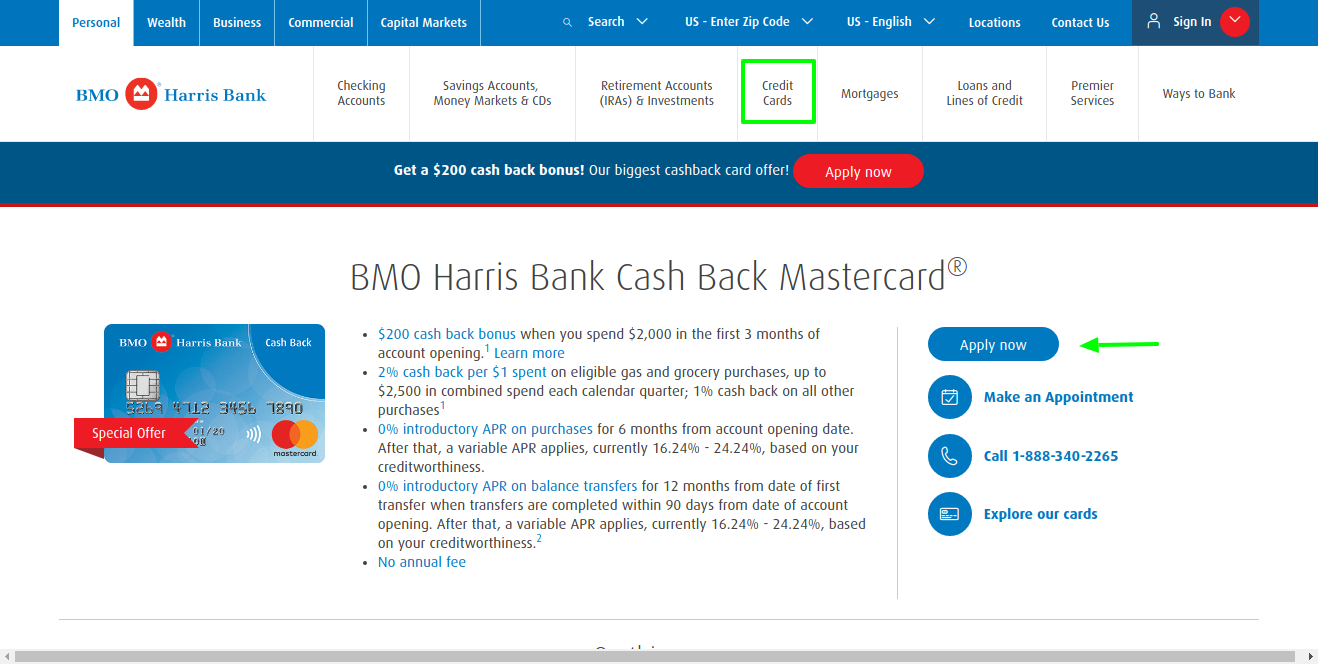

To apply for the BMO Harris Card you have to venture to, www.bmoharris.com

Here at the landing page, you will get two menu panels, and you have to go for the second. Here in this white panel, you have to go and click on the fourth option, ‘Credit cards’. Upon clicking on it, you will get two lists and in the first one you have to choose and press on the second card, ‘Cash Back Mastercard’ under the section, ‘Credit cards’.

In the next page, you will have to look at the right side and you will get the option for, ‘Apply now’ in blue.

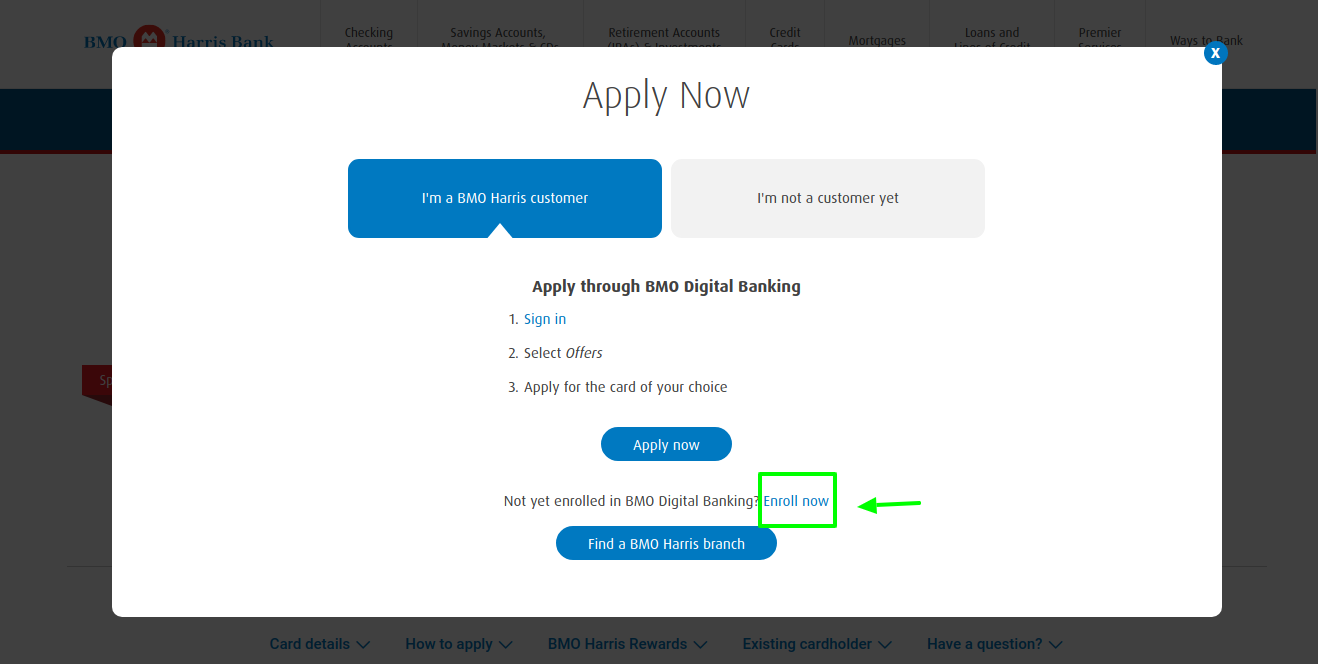

Now, you will get a white box open on the screen. Here you will get to know that after signing in to the online account, you can apply for this card.

Also, if you are not a customer of this bank then you have to venture to the bank in person by visiting this site, branchlocator.bmoharris.com here you have to type your address and you will get to know the nearby place.

Register for Cash Back Mastercard

You need to enroll for the card application then you have to visit, www.bmoharris.com

Here at the landing page, you will get two menu panels, and you have to go for the second. Here in this white panel, you have to go and click on the fourth option, ‘Credit cards’. Upon clicking on it, you will get two lists and in the first one you have to choose and press on the second card, ‘Cash Back Mastercard’ under the section, ‘Credit cards’.

In the next page, you will have to look at the right side and you will get the option for, ‘Apply now’ in blue.

Now, you will get a white box open on the screen. Here you will get to know that after signing in to the online account, you can apply for this card. Under the information in this box, at the bottom middle press on, ‘Enroll now’.

Here you will get blanks at the right side and you have to enter,

Account type

Account number

Your SSN or TIN number

Then at the right side press on, ‘Continue’.

Do follow the prompts after that, and you will be able to register.

Logging in to the Cash Back Mastercard

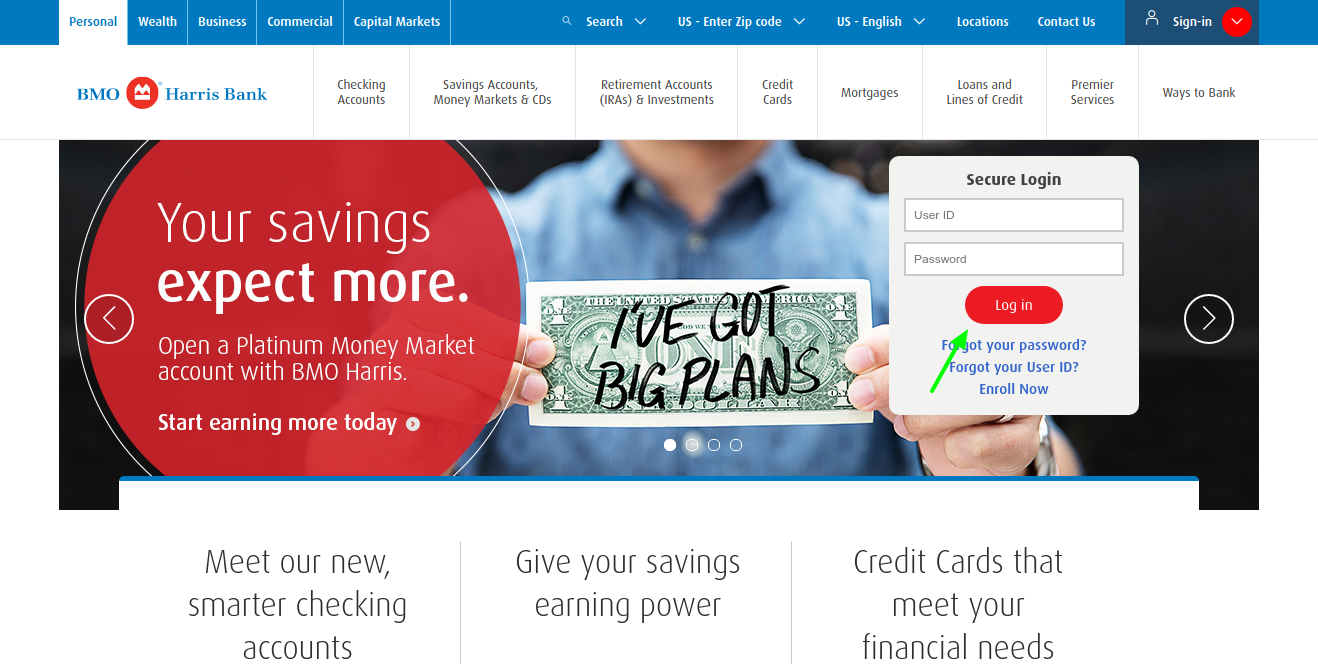

For the Comenity bank log in you need to visit, www.bmoharris.com

Here at the landing page, you will get two menu panels, and you have to go for the second. Here in this white panel, you have to go and click on the fourth option, ‘Credit cards’. Upon clicking on it, you will get two lists and in the first one you have to choose and press on the second card, ‘Cash Back Mastercard’ under the section, ‘Credit cards’.

In the next page, you will have to look at the right side and you will get the option for, ‘Apply now’ in blue. Now, you will get a white box open on the screen. Here you will get to know that after signing in to the online account, you can apply for this card. Hereunder the information, you have to click on, ‘Apply now’.

Here you will get the login box at the right side, and you have to input, the user ID and the confirmed password, then under the password blank, press on, ‘Login’.

Forgot username or password

If you have lost the login details of BMO Harris, then you need to go to the same page login box, here, under the login blanks at the left bottom side you will get the option for, ‘Forgot your password?’. On the directed page, you need to enter,

User Name

The Social Security Number

After typing the details at the bottom right side click on, ‘Continue’.

For the username, ‘Forgot your user ID?’.

Here type the

Email address

Your SSN

After typing the details at the bottom right side click on, ‘Continue’.

Follow the prompts after this and in this way you will get the login details back.

Pros and cons of Cash Back Mastercard

Pros

You get to avail the no penalty APR

Get value-added benefits

Get sign up bonus

No annual fee has to pay from your side

Cons

The annual fee is high

There is no 24/7 customer service

There is a foreign transaction fee

You will get mediocre cashback earnings

Bill payment of Cash Back Mastercard

There are 5 ways to pay the bill of BMO Harris, online payment, by mail, by phone, direct deposit, automatic payments. To make payments you have to venture to, www.bmoharris.com

Here at the landing page, you will get two menu panels, and you have to go for the second. Here in this white panel, you have to go and click on the eighth option, ‘Ways to bank’. Here you will get two options and from here you have to choose the second one under the section, ‘Other banking services’, you have to click on, the second option, ‘Payment and deposit services’. Here you will get two options at the middle left of the page, ‘Direct deposit’ and ‘Automatic payments’.

Online payment

You have to pay the bill by logging into your online account. At the time you log in to your account online you can make payments from any device that is secure, and free. You can easily schedule one time payments or recurring monthly payments to your registered account. You have to pay at least the minimum payment due stated in your monthly bill.

By mail

You can send a cheque to,

BMO Harris Credit Cards, P.O. Box 6012, Carol Stream, IL 60197. You have to make sure to write the payment details at the back of the cheque, like the account number.

By phone

If you want to make payment through phone then you have to call on, 855-825-9237.

Direct deposit

You have to download, www.bmoharris.com/Direct-deposit

And by filling this you have to attach a voided check from your checking account. For Direct Deposit to a savings account, just complete the form.

For the business clients, if you are unsure of the type of account that you have, you have to contact the Business Banking team at 1-888-340-2265.

Automatic recurring payment

For this, you have to log into your account and by that, you can set up the automatic payment.

In so many cases, the payment date and the amount of the payment will be based on the terms of the loan.

Also Read : How To Pay BMO Harris Credit Card Bill Online

Customer service

If you are looking for any help or issue resolution with BMO Harris Card then you can always call on the toll-free number, 1-888-340-2265.

Reference :