Arizona state department has its headquarter in Phoenix, United States. If you have worked in this state and made some good profit then you need to file a state tax return. You can have the benefit by mail, and there is an online option too.

If you have a business then you can enroll with the department online and upon login, you can have the benefits of payment. On the other hand, if you are an individual you don’t need to log in and you can file for a refund easily.

Enroll with Arizona state department

To enroll go to, www.aztaxes.gov

On the exact page, scroll down and under the businesses, sector click on, ‘Login to AZTaxes’.

You will be taken to the next page, and here press on, ‘New user enrollment’.

Click on ‘Continue’ at the adjacent page, and you will go to the registration page.

Here type your,

First name

Middle name (optional)

Last name

Phone number

Extension

Email

Confirm the same

Accept the terms of the policy and click on, ‘Register’.

Follow the prompts after this and you will be registered properly.

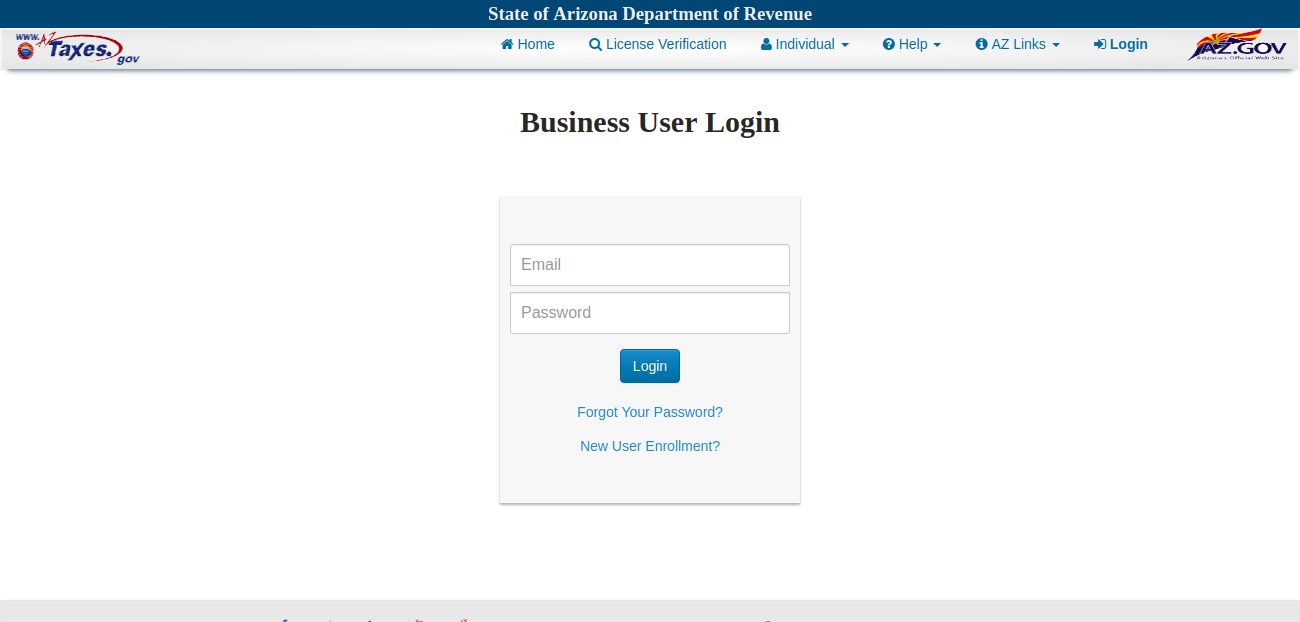

Logging in to your Arizona state department account

To log in, visit, www.aztaxes.gov/Home/Page

Here under the ‘Businesses’ click on, ‘Login to AZTaxes’.

On the next place, type the registered email address, the confirmed password, and press on, ‘Login’.

Forgot username or password

If you have forgotten your login details of Arizona state department then visit the same page and in the login page, hit on, ‘Forgot your password?’. Here input the registered email address and click on, ‘Login’. Follow the later details and you will be able to reset the password.

If you are an individual and looking for a refund on taxes then you have to follow some steps to get the same.

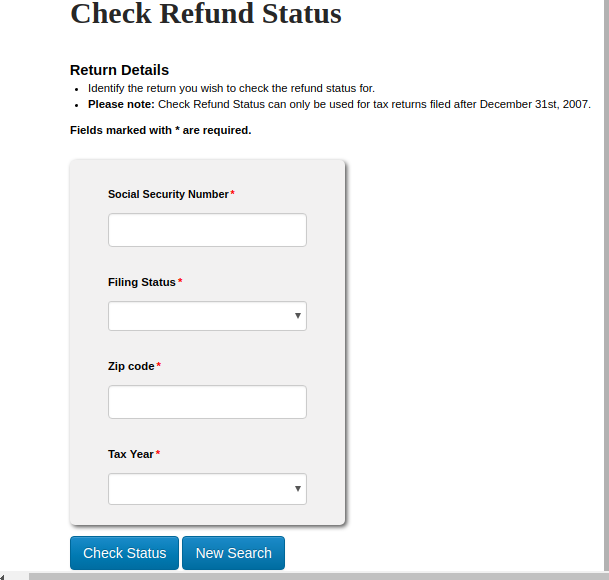

Get the refund for Arizona state taxes

For this you need to visit, www.aztaxes.gov/Home/Page

Here scroll down and under the ‘Individuals’ press on, ‘Where’s my refund?’.

On the next page, type,

Your social security number

Filling status

Zip code

Mention the tax year and click on, ‘Check status’.

Follow the later instructions and get the details on the same.

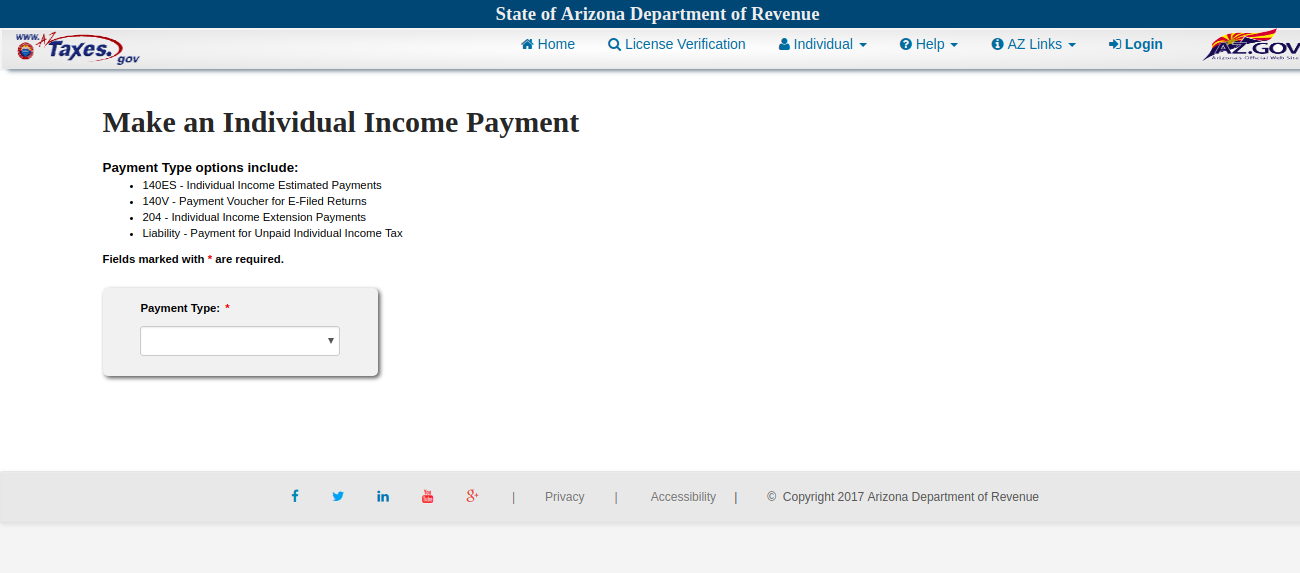

Payment for Arizona state taxes

If you are an individual you will get two options, online and mail. For online, you have to visit, www.aztaxes.gov/Home/PaymentIndividual

Online payment

To pay online you need to visit the earlier mentioned link and here mention the,

Payment type

State the filing status and click on, ‘Continue’.

Follow the prompts after that and filling every other detail you will be able to pay the tax.

Payment by mail

To pay by mail you have to go to, www.azdor.gov/forms/individual

From here you need to download the form that applies for you and send the payment to, Arizona Department of Revenue, P.O. Box 52016, Phoenix, AZ, 85038. If you do not owe anything then return the payment at, Arizona Department of Revenue, P.O. Box 52138, Phoenix, AZ, 85038.

Contact details

If you are seeking any help from the Arizona tax department then you can call at the toll-free number- (602) 255-3381. Or you can send a mail to, 1600 West Monroe Street

Phoenix, AZ 85007.

Reference :

www.azdor.gov/forms/individual

www.aztaxes.gov/Home/PaymentIndividual