Apply And Pay For Capital One Quicksilver

Capital one is the 10 th largest bank by its entire assets in the U.S. Which is $362 Billion. This is a bank holding company that specializes in banking, savings accounts, credit cards and has revenue of 2,807.6 crores USD. The capital bank has its headquarter in, McLean, Virginia, the United States and has 49,301number of employees. The bank also has some subsidiaries such as Paribus, Critical Stack, ShareBuilder and so on. There are 14 cards in total, they are, Venture rewards, VentureOne rewards, Quicksilver rewards, Savor rewards, SavorOne rewards, QuicksilverOne rewards, Platinum, Journey student rewards, Secured Mastercard, Spark cash, Spark miles, Spark cash select, Spark miles select, Spark classic.

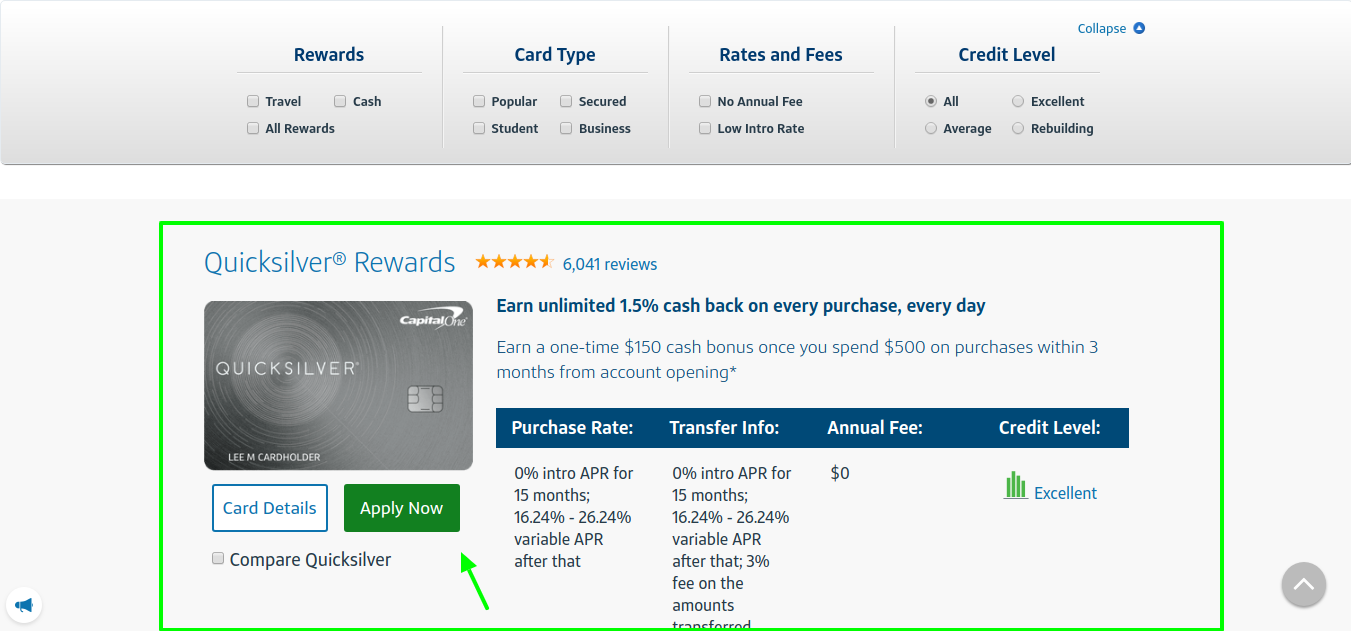

Benefits of Capital One Quicksilver

Get to earn unlimited 1.5% cashback on every purchase, every day

You will get new Cardmember Offer

You will earn a one-time $150 cash bonus once you spend $500 on purchases within 3 months from account opening

Annual Fee is $0 intro for the first year

No Foreign Transaction Fees you have to pay

Get security with Account Alerts

Get to lock your card

You will get fraud Coverage

The Capital One Mobile app is quick and securely with your fingerprint or customized pattern.

You will get account Alerts

Get to set up personalized email or text reminders which will help you to stay on top of your account.

Get to pay by Autopay

Get to see your Monthly Recurring Transactions

You can add authorized User

You will be able to do balance Transfer

Get 24/7 Customer Service

Rates and fees of Capital One Quicksilver

APR is 16.24% to 24.24%

The purchase intro is 16.24%

Returned Payment is Up to $38

The late payment is $38

The annual fee is $0

Eligibility criteria for Capital One Quicksilver

Your age has to be at least 18 years

Have to have a U.S. Social Security Number

Have to have a street, rural route, or APO/FPO mailing address.

Apply for Capital One Quicksilver

To apply for the Capital One Quicksilver you have to venture to, www.capitalone.com. Here on this page, you will get a menu panel at the upper left side, and here you have to choose the first option, ‘Credit cards’.

You will get a drop-down where you will get three lists, on the first one, you have to look at the bottom left, here you will get the button, ‘Compare all cards’ in the blue box.

Clicking on it will direct you to the all cards page. Here you will get a list of the 14 cards, and you have to choose and press on the third one, ‘Quicksilver’.

Upon reaching this particular card page, you will get the ‘Apply now’ button at the middle right side in the green box. You have to click on the same, and you will be taken to the application page. In here, you will get the blanks, and you have to input,

First name

Middle name

Last name

Date of birth

Social security number

Specify if you are you a U.S. Citizen?

Residential address

Suite or apartment number

Email address

Primary phone number

Employment status

Total annual income

Monthly rent or mortgage

Specify if you have any bank accounts?

Credit card spend per month

Specify if offered, would you be interested in blank checks to use for cash advances?

You have to specify if you get approved, do you plan to transfer any balances from other non-capital one credit cards?

After typing all these details, you need to look at the bottom middle and here click on ‘Continue’.

Follow the details after this and you will be able to apply for the card.

Register for Capital One Quicksilver

To register you need to visit, www.capitalone.com

Here on the landing page just under the left side menu panel, you will get the sign in initials, and here under the ‘Sign in’ logo click on, ‘Or set up online access’.

In the next page, you have to enter,

Last Name

Social Security Number or ITIN or your Bank Account Number

Date of Birth

After that press on, ‘Find me’.

Do follow the prompts after that, and you will be able to register.

Logging in to the Capital One Quicksilver

To log in you need to visit, www.capitalone.com. Here on the landing page just under the left side menu panel, you will get the sign in initial. In here type the username and the confirmed password. Then at the right side click on, ‘Sign in’.

Forgot username or password

If you have lost the login credentials of Capital One Quicksilver, then you need to go to the same page login panel, here, at the side of the login blanks at the right side you will get the option for, ‘Forgot username or password?’. On the directed page, you need to enter,

Last Name

Social Security Number

Date of Birth

After that press on, ‘Find me’.

Follow the later prompts and this way you will get the login details back.

Activate the Capital One credit card

To activate the card you have to sign up then sign in for the card online account, and after that, your card will be activated normally.

Pros and cons of Capital One Quicksilver

Pros

Earned rewards don’t expire

You will get no limit to how much you can earn

You will get to redeem for any amount, any time you want

Get to redeem for statement credits, checks, gift cards and many more

You will get an automatic redemption option

You will get to redeem for previous purchases

Cons

There is no introductory balance transfer in APR that you will get

The APR is high

Bill payment of Capital One Quicksilver

There are 3 methods to pay the bill of Capital One Quicksilver, online payment, by mail, by phone. The credit card payment can be made from Comenity capital bank. So to make payments you have to venture to, www.capitalone.com

Here on this page, you will get a menu panel at the upper left side, and here you have to choose the first option, ‘Credit cards’.

You will get a drop-down where you will get three lists, on the third one under the section, ‘Common account task’ you have to press on, the fourth option, ‘Pay my credit card bill’ On the next page you will get the login blanks, which is the indication of the online payment gateway. You will find the other two payment information after you successfully log into your card account.

Online payment

You have to pay the bill by logging into your online account. At the time you log in to your account online you can make payments from any device that is secure, and free. You can easily schedule one time payments or recurring monthly payments to your registered account. You have to pay at least the minimum payment due stated in your monthly bill.

By mail

You can send a cheque to this address,

Capital One, Attn: Payment Processing, PO Box 71083, Charlotte, NC 28272-1083. You have to make sure to write the payment details at the back of the cheque, like the account number.

Also Read : How To Pay Capital One Journey Student Rewards Bill

By phone

If you want to make payment through phone then you have to call on, 1-800-227-4825. For the Capital One small business credit card, you have to call on: 1-800-867-0904.

Customer service

If you are looking for any help or issue resolution with Capital One cards, then you can always call on the toll-free number, 1-800-227-4825. For foreign, call: 1-804-934-2001. For the small business credit cardholders: 1-800-867-0904.

Reference :

www.capitalone.com/credit-cards

www.capitalone.com/credit-cards/quicksilver